When GST or Goods and Services Tax was first introduced on July 1st, 2017, it brought in a paradigm shift in the entire taxation process. GST removed the concept of double-taxation on products and services and introduced the concept of One India, One Tax regime.

One of the most beneficial features which GST introduced for all businesses is Input Tax Credit or ITC.

This feature helps businesses to avoid paying double or triple taxes on the same product/service and keeps the calculation of paying GST simple, and to the advantage of the companies.

Since GST is an indirect, destination-based tax system, the input tax credit was needed so that the businesses don’t end up paying double tax on the same product: Once while procuring raw materials, and a second time when selling it as a finished good.

In this article, we will share what is ITC in GST, and how to claim ITC in GST. Besides, we will also share the process of reversal of ITC in GST, and tell how to reverse excess in ITC claimed in GSTR 3B form.

But first, let’s understand what is an input tax credit in GST?

What is Input Tax Credit in GST?

Input Tax Credit is like a tax cashback for the business. It means that while paying tax on the output, the business can reduce the tax, which was already paid on the input. For understanding what is ITC in GST, we will use an example.

Say, there is a manufacturer A who makes shoes. While buying raw materials for making shoes, A paid Rs 250 as input tax. He makes the shoes using the raw materials, and while selling the shoes (the final product), he has to pay Rs 450 as output tax. While paying the output tax of Rs 450, manufacturer A can claim an input tax credit for Rs 250 and pay only Rs 200 as GST (output tax – input tax). There can be multiple input taxes associated with the same product, for example, raw material 1, raw material 2, and so on.

While calculating the input tax credit, the total input tax generated should be calculated and balanced off against the final output tax.

Who Can Claim Input Tax Credit?

The following mentioned conditions should be fulfilled:

- The dealer should have a tax invoice at the time of claiming the input tax credit.

- The claimed goods/services have been received.

- GST returns have been filed

- The supplier of the raw materials have paid the taxes to the Govt

- If the goods are received in installments, then the ITC can be claimed after the last lot is received.

- In case depreciation has been claimed on the capital goods’ tax component, ITC can’t be claimed.

- ITC can be only and only claimed for business purposes. If goods and services are used for personal use, then no ITC is allowed.

How to Claim ITC in GST?

While filing the monthly GST returns via Form GSTR-3B, a taxpayer can claim the input tax credit, right in the form itself.

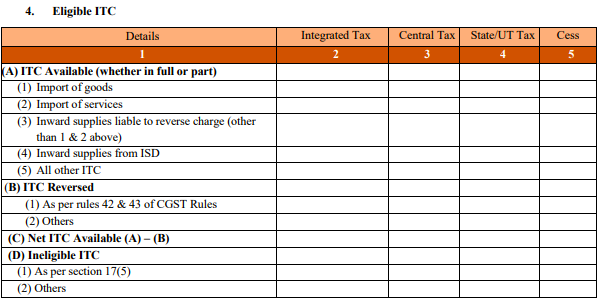

Table 4 within GSTR-3B is used exclusively for claiming the input tax credit.

Table 4 within GSTR-3B

In table 4, you can file a summary of input tax credit claimed:

- Eligible ITC

- Ineligible ITC

- Reversal of ITC in GST

Here’s a short brief on the contents of Table 4 under GSTR-3B:

ITC Available

- Table 4(A)(1): Total GST paid on import of raw materials, as per bill of entry

- Table 4(A)(2): Reverse Charge Mechanism paid on import of services

- Table 4(A)(3): Reverse Charge Mechanism paid on other than services

- Table 4(A)(4): ITC for inward supply and distribution from Input Service Distributor

- Table 4(A)(5): All other ITC, including capital goods

ITC Reversal

- Table 4(B)(1): Reversal of input tax credit, only for exempt supplies

- Table 4(B)(2): Other reversal of input tax credit: blocked credit u/s 17

Net ITC Available

- Table 4(C): Net input tax credit available for adjustment towards output liability

Ineligible ITC

- Table 4(D)(1): Details of blocked input tax credit: Food, Cab, Free Sample, etc

- Table 4(D)(2): Other ineligible credit

An important thing to note here: On a provisional basis, a taxpayer can claim up to 20% of the eligible input tax credit, as reported by the suppliers via the GSTR-2A return form.

Thus, it is recommended the taxpayer match the numbers with their suppliers’ data. This way, the data entered in the GSTR-2A return form should match with the data mentioned in GSTR-3B.

How to Reverse Excess ITC Claimed in GSTR-3B

Earlier, any information you file and submit via GSTR-3B form, including input tax credit information, could not be edited or reversed.

But now, the Income Tax Department has allowed resetting the GSTR-3B information. In this, the status of “Submitted” will be changed to “Yet to be filed”, and all the details entered via GSTR-3B will be available to edit.

Besides, all the entries available under Electronic Liability Register will be deleted as well, and all the entries under the input tax credit integrated with Electronic Liability Register will be reversed.

However, this option is only available once. The better option is to preview the filings before submitting it. At the same time, there are other provisions on how to reverse excess ITC claimed in GSTR-3B.

If you need more assistance and expert GST advice on input tax credit and reversal of ITC in GST, then MSMEx can help you. With its unique platform, entrepreneurs and MSMEs can connect with business experts, tax experts, govt. schemes experts, marketing experts, and more.

MSMEx.in empowers entrepreneurs with the right knowledge, at the right time, from the right expert!